Chapter 5 corporate tax stds (2)

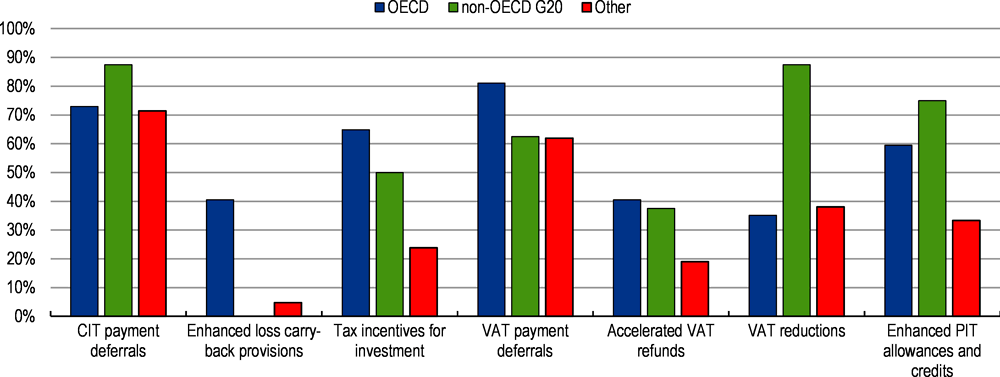

Tax and fiscal policy in response to the Coronavirus crisis

COVID-19 Pandemic - Accounting Method Planning to Defer 2019

Tax deduction impacted by payroll tax deferral Grant Thornton

Tax Deductions and Write-Offs for Sole Proprietors Fifth Third Bank

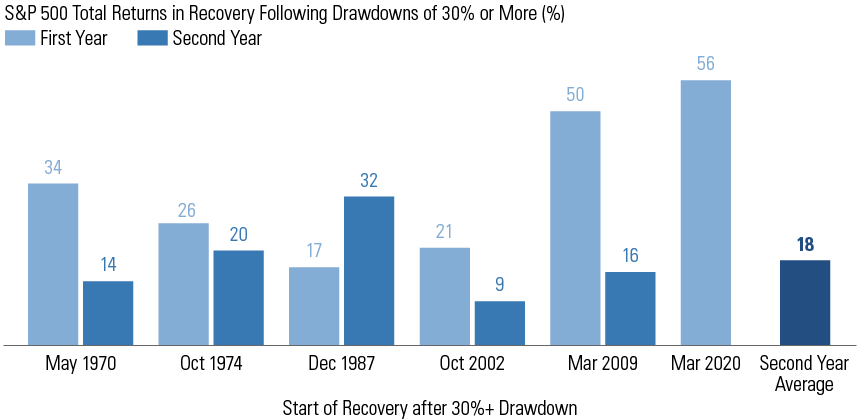

Four Challenges for Investors Today

Overview of Australian Taxation Functionality (Oracle Financials

Government support schemes for COVID-19 TMF Group

Making Adjusting Entries for Unrecorded Items Wolters Kluwer

2. Update on the tax measures introduced during the COVID-19

Training - Modular Financial Modeling II - Corporate Taxation

Deferred Tax Asset Journal Entry How to Recognize?

Tags:

archive