S-1

IRS releases final GILTI regulations Grant Thornton

Training - Modular Financial Modeling II - Corporate Taxation

Training - Modular Financial Modeling II - Corporate Taxation

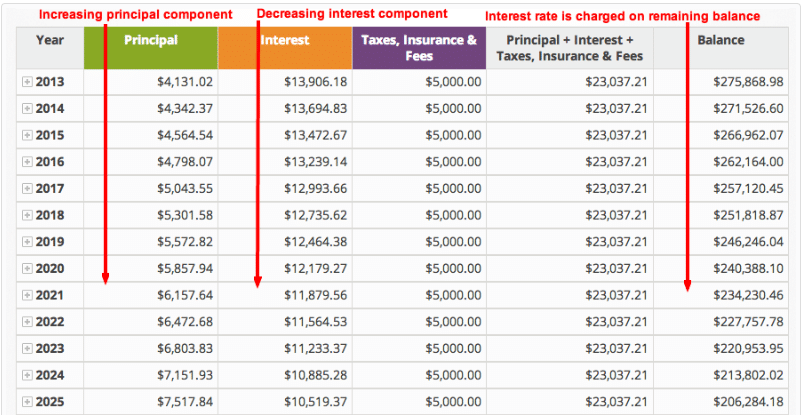

How to Calculate Amortization Expense for Tax Deductions

The territorial impact of COVID-19: Managing the crisis across

Malaysia Personal Income Tax Guide 2021 (YA 2020)

How to Calculate Amortization Expense for Tax Deductions

Tax and fiscal policy in response to the Coronavirus crisis

Malaysia Personal Income Tax Guide 2021 (YA 2020)

INSIGHT: Sharia Instruments of Financing-Tax Implications (Part 2)

Tax and fiscal policy in response to the Coronavirus crisis

Tags:

archive