Bonus depreciation allowable for certain stepped-up basis transactions

Malaysia Personal Income Tax Guide 2020 (YA 2019)

Corporate Tax 2021 - Malaysia Global Practice Guides Chambers

Now, make private use adjustments for fixed assets Xero Blog

Bonus depreciation allowable for certain stepped-up basis transactions

Fixed Asset Accounting: Overview and Best Practices Involved

Complete Guide of Tax Deductible Expenses for Hong Kong Company

Credit access, tax structure and the performance of Malaysian

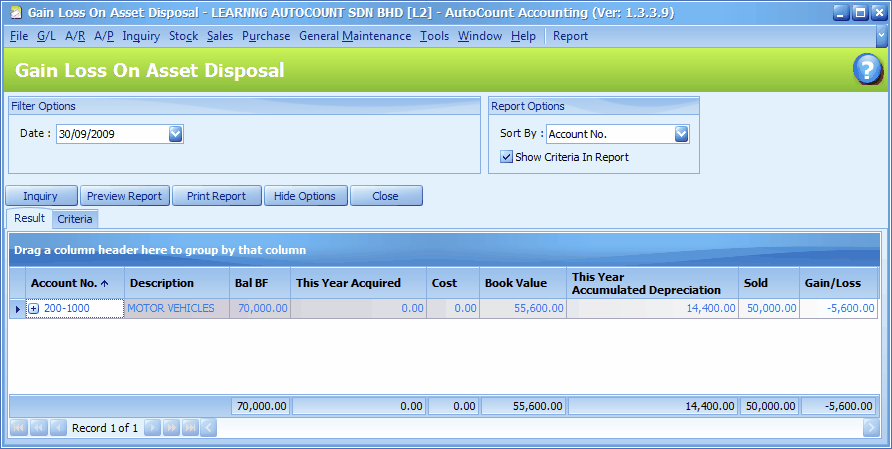

AutoCount Accounting Help File 2009

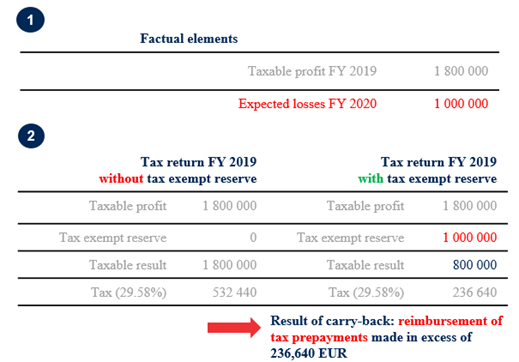

Belgian Law introducing one-off loss carry-back regime published

Bonus depreciation allowable for certain stepped-up basis transactions

IRS releases final GILTI regulations Grant Thornton

Tags:

archive