Expanded bonus depreciation guidance issued Grant Thornton

Tax treatment of software and website costs The Association of

How to Calculate Amortization Expense for Tax Deductions

Malaysia Personal Income Tax Guide 2020 (YA 2019)

Complete Guide of Tax Deductible Expenses for Hong Kong Company

KTP & Company PLT Audit, Tax, Accountancy in Johor Bahru.

Can the bank take your assets if you have defaulted on a personal

Carried interest tax proposals: What you need to know Private

Tax Policy Reforms 2020 : OECD and Selected Partner Economies

Decommissioning of oil and gas assets: industrial and

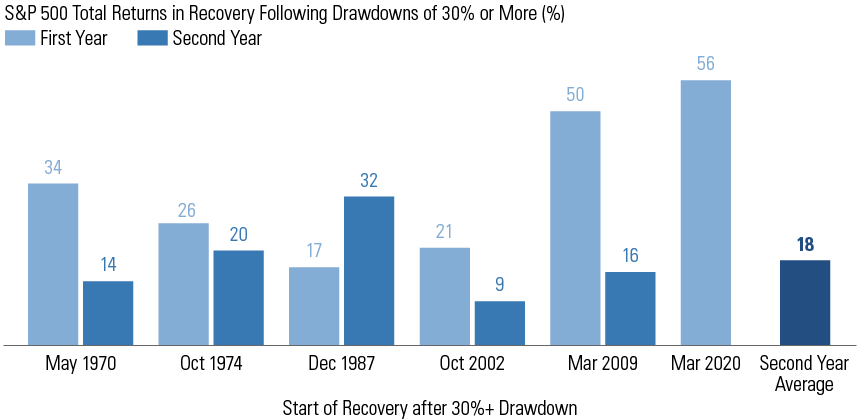

Four Challenges for Investors Today

TaxPlanning: So, you want to start your own business u2026 The Edge

Tags:

archive