How to Calculate Amortization Expense for Tax Deductions

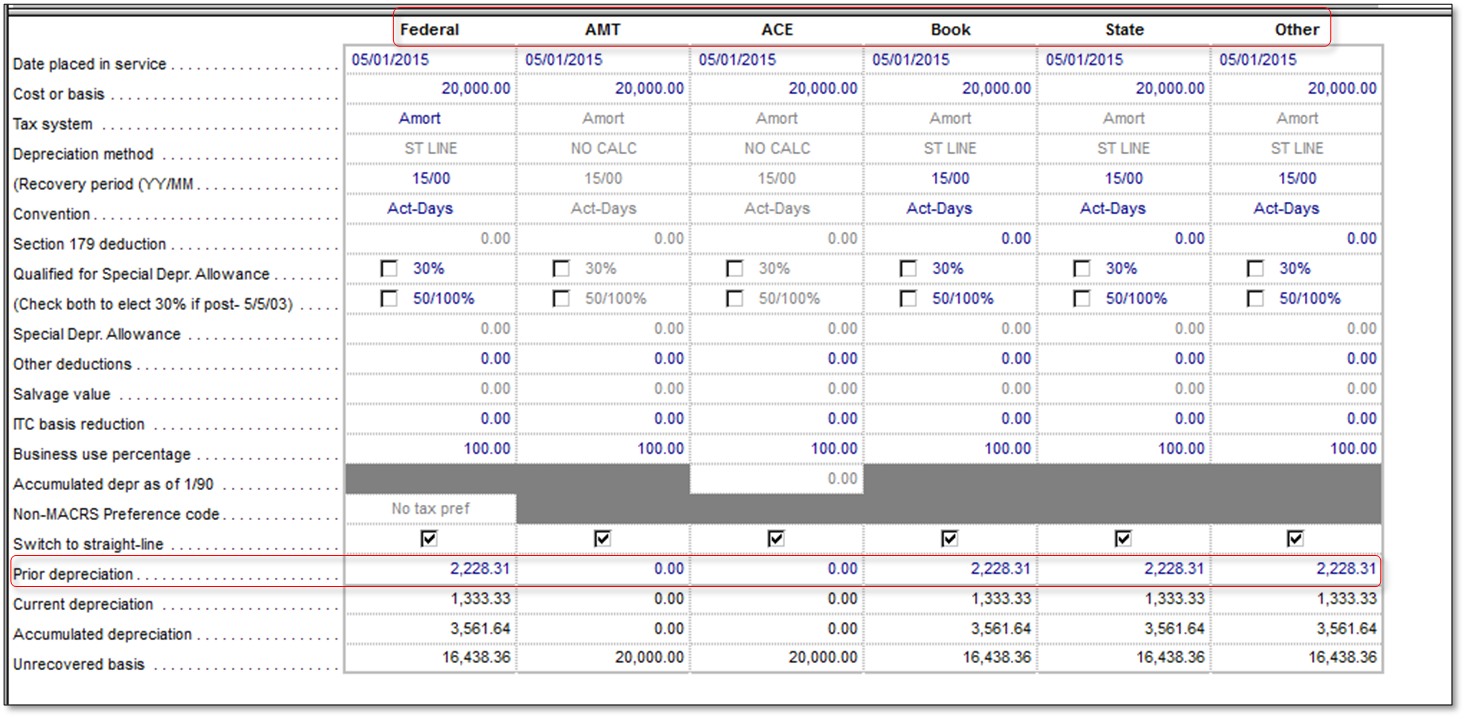

Use Fixed Asset Manager in QuickBooks Desktop

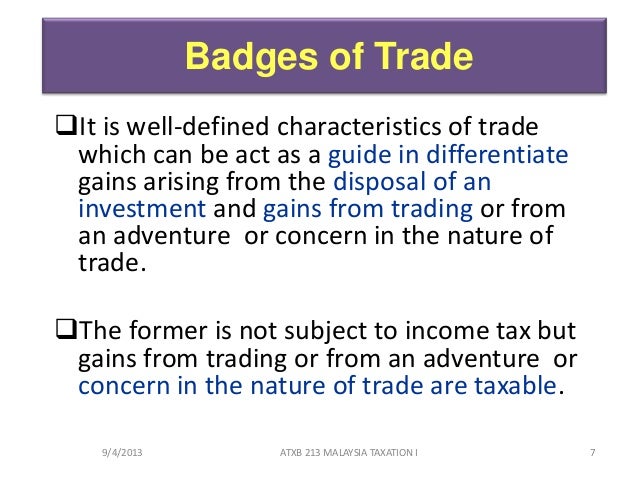

Chapter 6; business income students (1)

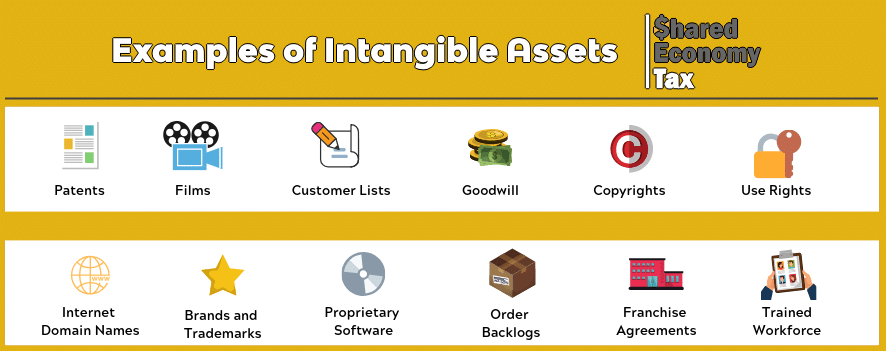

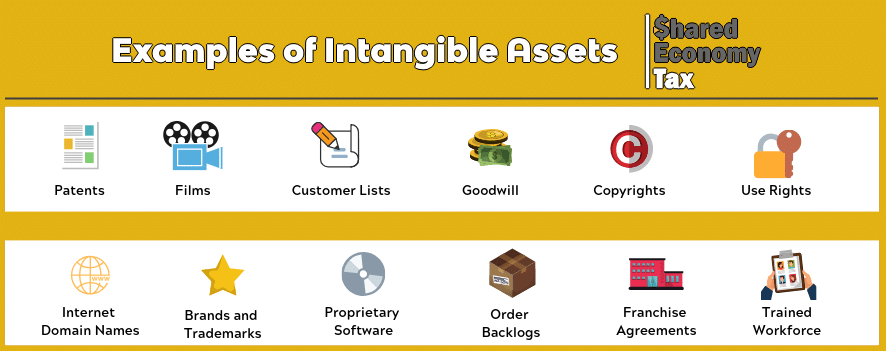

How to Calculate Amortization Expense for Tax Deductions

Understanding Asset Depreciation & Section 179 Deductions Paychex

Corporate Tax 2021 - Malaysia Global Practice Guides Chambers

Tax Tips For The Self-Employed Massage Therapist DiscoveryPoint

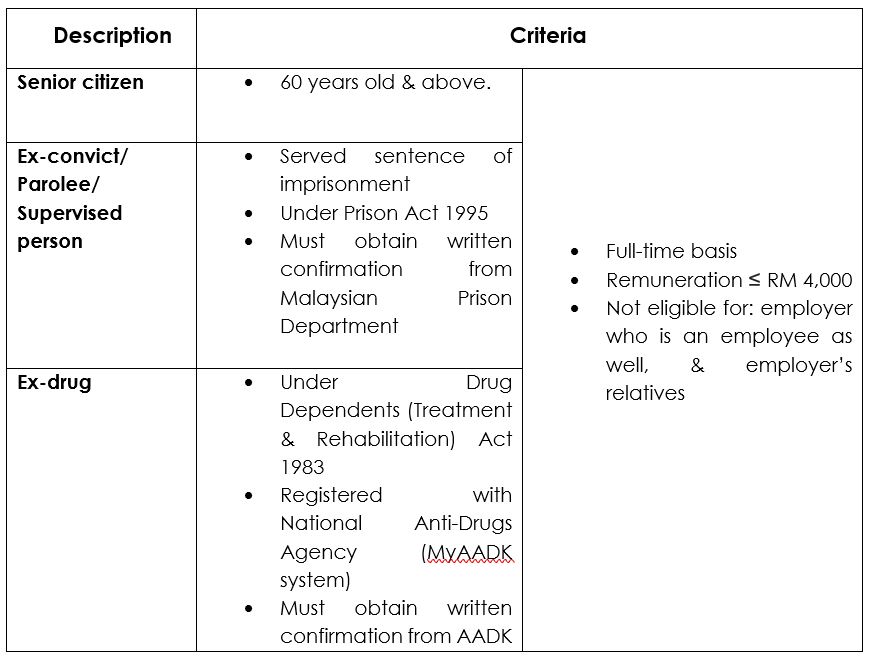

List of tax deduction for businesses - Cheng & Co Group

Can the bank take your assets if you have defaulted on a personal

Capital gains tax - Wikipedia

INSIGHT: Sharia Instruments of Financing-Tax Implications (Part 2)

TheWall: Profited from trading bitcoin? Find out if you need to

Tags:

archive